Choosing the right actuated valves for your system is a critical decision that can significantly impact operational efficiency and safety. According to a recent report by MarketsandMarkets, the global actuated valves market is projected to reach $4.67 billion by 2025, growing at a CAGR of 5.6% from 2020. This growth underscores the importance of selecting valves that not only fit the specific requirements of your application but also integrate seamlessly with the overall system. Actuated valves play a vital role in various industries, including oil and gas, water and wastewater, and food and beverage, where precise control of flow and pressure is essential. With a myriad of options available, understanding the key factors—such as type, material, and actuation method—is crucial for ensuring optimal performance and reliability in your operations.

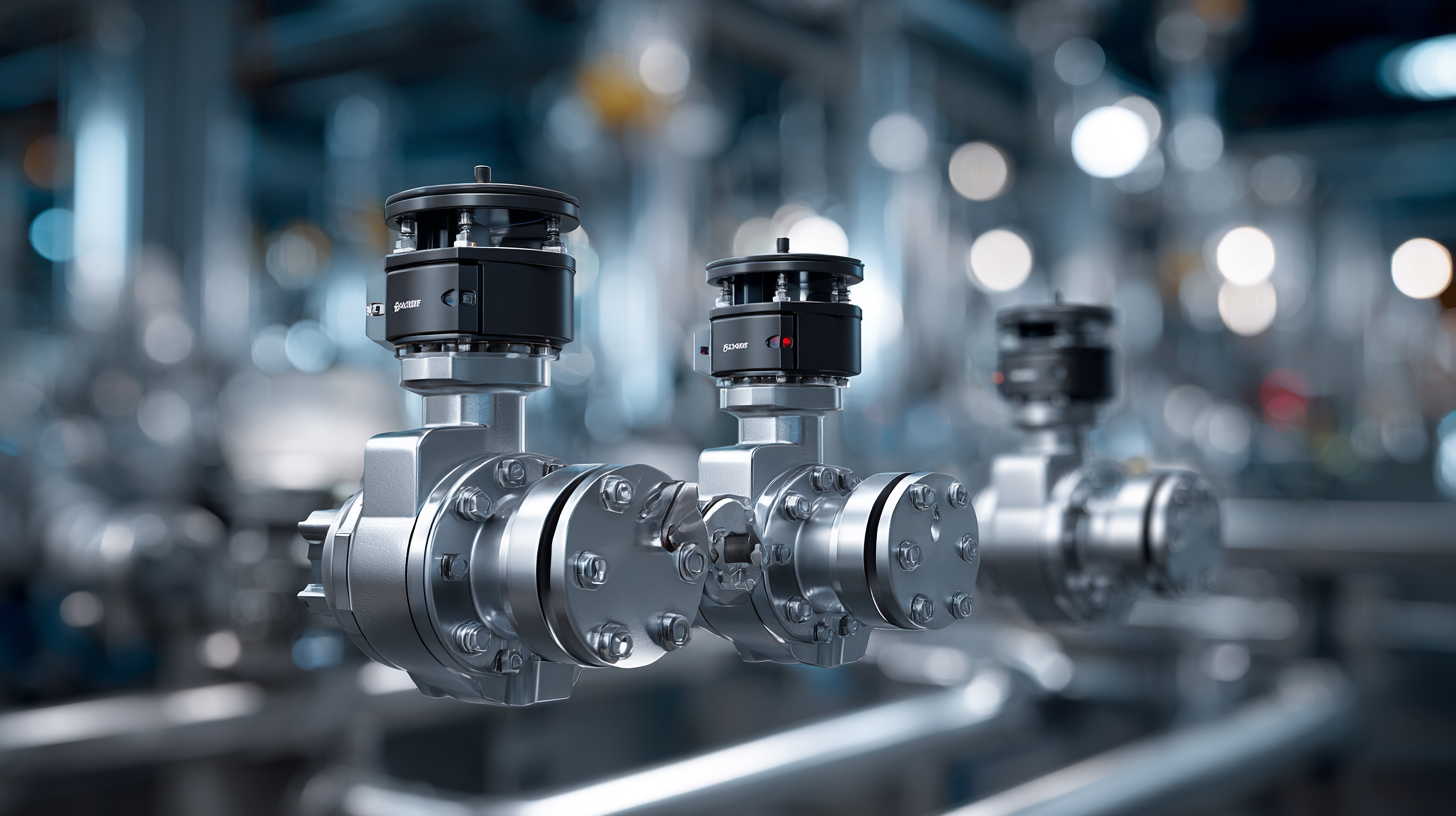

Actuated valves play a crucial role in controlling fluid flow within industrial systems. Understanding the various types of actuated valves and their specific applications can significantly enhance system efficiency. Common types include electric, pneumatic, and hydraulic valves, each designed to suit different operational requirements. Electric actuated valves are favored for their precision in applications requiring accurate flow control, while pneumatic valves are ideal for environments where quick response times are essential. Hydraulic valves, on the other hand, are useful in high-pressure scenarios.

When selecting actuated valves, consider the operating environment and system specifications. For example, ensure the valve material is compatible with the media it will control to prevent corrosion or degradation. Additionally, the size of the valve should match the flow requirements of your system to maintain optimal performance.

**Tips:** Always consult with a valve manufacturer regarding pressure ratings and temperature limits to ensure the selected valve meets all form and functional requirements. Testing the valve in a controlled environment before full-scale implementation can also help identify any potential issues early on, ensuring smooth operation once integrated into the broader system.

| Valve Type | Actuator Type | Control Method | Applications | Size Range (inches) | Pressure Rating |

|---|---|---|---|---|---|

| Ball Valve | Electric | On/Off | Oil & Gas, Water Treatment | 0.5 - 12 | ANSI Class 150-600 |

| Globe Valve | Pneumatic | Modulating | Chemical Processing, HVAC | 0.5 - 8 | ANSI Class 150-300 |

| Butterfly Valve | Electric/Pneumatic | On/Off or Throttling | Water Supply, Wastewater | 2 - 48 | ANSI Class 150-300 |

| Check Valve | None | Automatic | Pumping Systems, Backflow Prevention | 2 - 24 | ANSI Class 150-350 |

When selecting actuated valves for process engineering systems, several key factors come into play that can significantly influence performance and efficiency. One of the foremost considerations is the valve type, which can include globe, ball, and butterfly valves. According to a recent report by MarketsandMarkets, the global actuated valves market is projected to reach $7.2 billion by 2025, highlighting the growing demand for innovative solutions in fluid management across industries such as oil and gas, water treatment, and chemical processing.

Another critical factor is the control action required for the specific application. Whether the system demands full on/off control or modulating services directly influences the choice of actuator type, such as electric, pneumatic, or hydraulic. A study from the Control Valve Handbook indicates that approximately 50% of control valve failures are attributed to improper actuator selection, showcasing the importance of aligning actuator capabilities with system needs. Furthermore, environmental conditions, including temperature and pressure ranges, play a significant role in selection; failure to account for these can lead to operational inefficiencies and increased maintenance costs. By carefully evaluating these factors, engineers can optimize their systems for better reliability and performance in diverse processing environments.

The actuated valve market is experiencing robust growth, driven by advancements in automation technologies across various industries, including oil and gas, water treatment, and chemical processing. According to a recent report by MarketsandMarkets, the actuated valve market is projected to reach USD 16.8 billion by 2025, growing at a compound annual growth rate (CAGR) of 6.3% from 2020. This surge is indicative of the increasing adoption of smart technologies that enhance operational efficiency and system reliability.

Moreover, market share analysis reveals that electric actuators are leading the segment, driven by their precision and energy efficiency. The same report highlights that electric actuators are expected to hold approximately 45% of the market share by 2025. As industries prioritize sustainability and reduced energy consumption, the demand for electric and hybrid actuated valves is on the rise. Consequently, manufacturers are innovating to produce more efficient products that cater to these evolving market needs, contributing to the overall expansion of the actuated valve sector.

When selecting actuated valves for your system, evaluating performance metrics is crucial, as these metrics directly impact overall system efficiency. Actuated valve efficiency can be assessed through various factors, including response time, flow capacity, and energy consumption. A valve that responds quickly to control signals can significantly enhance the system's responsiveness, allowing for real-time adjustments that optimize operational conditions. Similarly, a valve's flow capacity must match the system's demands; otherwise, it can lead to pressure drops or flow restrictions that hinder performance.

Energy consumption is another vital performance metric to consider. Actuated valves that require minimal energy to operate not only reduce operational costs but also contribute to a more sustainable system. By analyzing the energy efficiency of different options, engineers can choose valves that ensure low power usage while maintaining peak performance. Ultimately, understanding these performance metrics enables system designers to select actuated valves that not only fit the technical requirements but also enhance performance and operational efficiency in the long run.

In high-stakes environments, selecting the right actuated valves involves rigorous adherence to safety standards and regulatory compliance. According to the International Society of Automation (ISA), over 40% of industrial accidents can be traced back to inadequate safety measures in valve operations. Thus, understanding relevant regulations, such as those outlined by the American National Standards Institute (ANSI) and the Pressure Equipment Directive (PED) in Europe, is crucial. These guidelines not only enhance system reliability but also reduce the risk of catastrophic failures.

Tip: When evaluating actuated valves, prioritize those that meet or exceed the latest safety certifications, such as ISO 9001. This certification can be a valuable indicator of a manufacturer's commitment to maintaining high-quality standards, which is essential in environments such as oil and gas facilities, where safety is paramount.

Furthermore, leveraging advanced technologies such as failure mode effects analysis (FMEA) can assist in identifying potential weaknesses in valve selection and integration. A report from the Fluid Controls Institute suggests that implementing predictive maintenance strategies can lead to a 25% reduction in unexpected failures in fluid control systems. Therefore, integrating regular assessment protocols and compliance checks will ensure continuous adherence to safety standards while optimizing system performance.

Tip: Regular training and drills for staff on handling actuated valves in compliance with established protocols can help mitigate risks and enhance operational safety in critical environments.

This chart illustrates the compliance levels of various actuated valves against key safety standards in high-stakes environments. The focus is on understanding how different valve types perform in meeting regulatory requirements.

Cepex is the brand for the fluid handling market belonging to the Fluidra group. One of the leading european manufacturer of valves and fittings in thermoplastic materials.

Dedicated to the swimming pool, irrigation and industrial markets, we distribute our products worldwide with the Fluidra commercial network and presence in 46 countries with 136 sales branches.